Doorstep loans are the borrowing services that deliver funds to your home. Also, the lender offers a home collection facility to collect the instalments. The loans provide financial ease to those who cannot go out to apply for loans from their banks. Many do not provide this facility. As an alternative lending company, HugeLoanLender offers short-term loans with cash-at-your-door services. Normally, the doorstep loans in the UK are convenient options for a certain type of borrowers. Those with any sort of difficulty in borrowing funds from conventional lenders opt for the comfort of doorstep loans.

Prime beneficiaries of doorstep loans are –

Many unemployed people feel neglected due to the continuous rejections from mainstream lenders. If you are also an unemployed individual, you are a risky borrower for the lender. You can lack a steady income and, thus, may not guarantee the loan repayment. It is where doorstep loans for the unemployed become handy.

This has been the trend going on for years. The present scenario of the UK marketplace is of modern-age lending or online lending. You can also say it as FinTech, where direct lending brings direct loan benefits for the jobless people. The best example of it is doorstep lending, where everything is done at the home of the borrower.

The question may arise:

Why is this not applicable to other loan options if approval is there on doorstep loans?

Again, direct lenders can only give the answers to these questions. They may advertise doorstep loans 4 unemployed as their loan products, but they also make this a reality.

Not one or two, but you have multiple ways to seek approval on a cash loan. These are:-

You can see multiple ways are there to get doorstep cash loans for the unemployed. The significant thing is your repayment capacity. Once you prove it, you will get funds on the spot, and therefore these loans are also known as doorstep guaranteed loans.

Lenders like us always consider your loan affordability because we offer only affordable loans. It helps you in two ways: to repay the loan easily and improve the credit score for more funding opportunities.

Therefore, proving your affordability is crucial before sending your loan application. You should not worry about your credit score as we also offer poor credit loans for doorstep.

You should start applying for loans now to get instant financial outcomes.

The doorstep loans today have new features because of the corona pandemic because the needs are different now. The financial crisis is bigger now, and as the direct lender, we can act flexibly according to your current needs. The latest circumstances have equipped them with certain features, and if you are searching for something like the best doorstep loans near me, we are a suitable place.

With the basic terms and conditions, you can cross the eligibility stage and borrow funds for any purpose. Only a few basic financial and personal details and you can apply for doorstep loans in Glasgow, Bristol, and Nottingham or anywhere in the UK.

The process is simple, fast, and predictable, as it is a direct lending platform that works on the principles of new age lending. The process starts online and ends at your home. The application process remains the same for all the borrowers, including those for doorstep loans with very bad credit people.

Once you get the loan, our home collection agent visits on every due date to collect the instalment from your home. Nothing is there to annoy you because everything happens right at your door.

There are multiple benefits of cash loans at door support during tough financial circumstances. Here are some of the most common benefits of doorstep loans that you should know.

The simplest answer is with a stable income and strong creditworthiness, one can get loans with doorstep services. With details, you need to follow certain terms and conditions to borrow money despite a less-than-perfect credit score.

HugeLoanLender is always there to support you during your financial crisis with the best deals in the UK. Reasonable rates and affordable repayments and funds for all purposes. We are right here, with a relatable loan offer. For every sort of borrower, we can figure out something useful.

Convenience in applying for doorstep cash loans is the primary concern of the borrowers. They certainly hate to indulge in lengthy steps. At HugeLoanLenders, they have the perfect opportunity to secure funds through a simple and straightforward online application system. To get an amount somewhere around 1000 pounds, they do not need to visit a lender’s office rather they have to follow these simple steps:

Such a smooth loan process allows quickly getting the advantages of doorstep loans for people living on benefits.

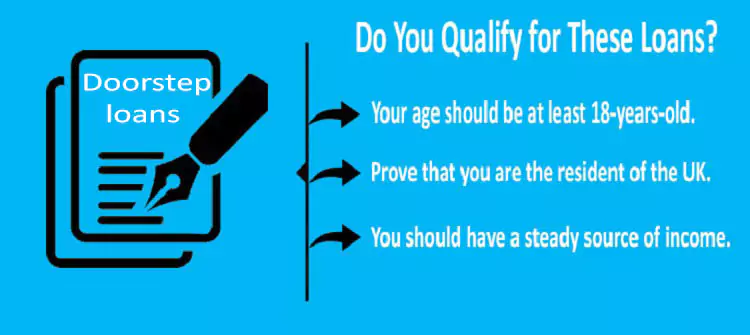

To acquire the benefits of loans, people need to require with the eligibility criteria and some of the conditions like:

Once they do that, we can assure them the guaranteed approval on their applications for doorstep loans with no credit checks. At the same time, they also get the same-day fund transfer to get away from a financial emergency.

It is not necessary that individuals have the bank account or the income status, and they have an immediate need for funding access. But these people do not need to worry too much because we have brought an alternative for them that come as doorstep loans for unemployed people.

We belong to the age of FinTech lending, and thus, we have opened our lending doors. For every individual irrespective of the credit score. We have personalized deals on doorstep loans with no credit check, where the features match the circumstances of the borrowers. Moreover, the repayment terms on the doorstep loans for people on benefits help them in improving their credit scores.

We need proper understandings of the borrowers’ financial problems and their limitations so that we can prepare value-based deals on doorstep loans for them. Therefore, they should be familiar with the amount they need and how they can repay the amount. Whether you need a £2K loan for bad credit or doorstep 4000 pound loans, your repaying capacity will be assessed carefully.

Do not waste your time and start applying for the doorstep loans for unemployed. Huge Loan lender feels proud to stand as your financial savior and provide the following benefits:

Being among most reliable and reputed online direct lenders in the UK, we always vouch for the best and bespoke lending for our prospective borrowers. Our online installment loans are the ideal example of what we are offering to you.

We belong to the modern-day lending but equally, give value to the traditional norms. One can tell us the perfect amalgamation of the conventional and modern lending hub. We are determined to offer you same day funding at your door without asking too much in terms of obligations.

The following advantages describe us very well:

Despite easier accessibility, you can face the rejection of taking out doorstep loans with no credit checks. The most common reasons for refusal include:

We consider all types of borrowers, and fund disbursal will be regarded on your affordability rather, than based on your poor credit history. You have to show up your capability of how you repay the amount. We will approve your amount on the spot. However, poor credit borrowers end up paying a bit higher interest rates than good credit borrowers pay. It will not take a toll on your finances, as you will get money based on your financial condition.

You are to abide by all terms and conditions of the contract you signed even if your financial circumstances turn upside down. You are likely to be strapped when the due date falls. Be open and honest about your financial situation. Inform the agent who has been in touch with you since starting. We will always try our best to provide you with a few alternatives to settle your dues. This process does not require any hidden charges.

There are many specific pre-conditions before signing the loan application. Loan duration is indeed one of them, and lenders are very much particular about these norms. However, you can reduce the period if you think that you can make the pre-payment of the borrowed amount. It requires a proper discussion with the lender, and do not hesitate to share everything with it.

Lending policies varied among the companies, some of them may allow pre-closure of the loan, and some will not allow the same. Therefore, please discuss all these things before applying for the loans.

If we go a few days back, then it would be tough for us to answer this question. But today’s scenario is entirely changed, and one can easily borrow amount despite not having the guarantor to back while confirming the loan contract.

There are some specific loan options available for the people who are not earning monthly income. Their job loss gives them lots of constraints in the way of borrowing funds. Doorstep loans are indeed among those specialized funding alternatives, which provide sufficient funding to the unemployed people.

The doorstep loan lenders are not reluctant to fund these people. The procedure will remain the same, and the repayments can get assured through the home-based work or part-time income. Lenders are happy that you can make the repayments, and thus, they straightway send their representative to your home to process everything.